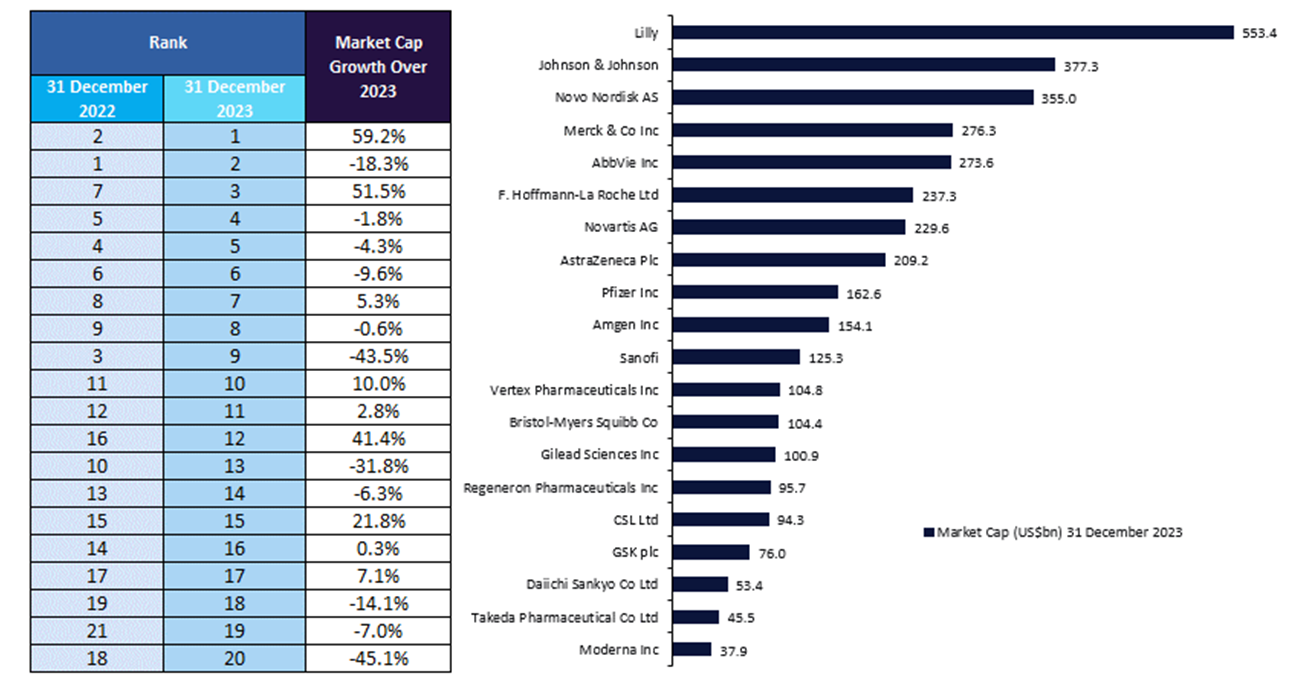

The top 20 biopharmaceutical companies saw prominent shifts in market capitalisation over 2023 despite macroeconomic challenges, upcoming patent cliffs, and US drug pricing negotiations under the Inflation Reduction Act (IRA). The top 20 biopharmaceutical companies experienced a total market capitalisation increase of 1.6% from $3.61tn on 31 December 2022, to $3.67tn on December 31, 2023, reveals GlobalData, a leading data and analytics company.

Lilly witnessed the largest market capitalisation growth of 59.2% to $553.4bn in 2023, displacing Johnson & Johnson as the top player in the biopharmaceutical industry. This growth was attributed to the company’s positive performance of its injectable synthetic peptide drug Mounjaro (tirzepatide; also known as Zepbound for obesity) for the treatment of type 2 diabetes in Q1, Q2, and Q3. Lilly’s growth was further fueled by tirzepatide’s FDA approval for the treatment of obesity received in Q3, which is expected to continue its sales growth. Mounjaro has a global analyst consensus sales forecast of $33.4bn by 2029, according to GlobalData’s Drugs Database in the Pharma Intelligence Center.

Similarly, the success of Novo Nordisk’s obesity and diabetes drugs—Wegovy (semaglutide) and Ozempic (semaglutide)—drove its market capitalization growth to $355bn in 2023, positioning Novo Nordisk in the top three global biopharmaceutical companies by market capitalisation in 2023. In February 2024, Novo Nordisk announced the $11bn acquisition of three manufacturing sites from US-based CDMO Catalent to expand its production in response to soaring demand for its obesity and diabetes drugs, as Wegovy and Ozempic achieved global sales of $4.4bn and $13.5bn in FY 2023.

Vertex moved up by four places in the list with a market capitalisation growth of 41.4% to $104.8bn in 2023, fueled by the FDA approval of its CRISPR-based ex vivo cell therapy Casgevy (exagamglogene autotemcel [exa-cel])—the first marketed CRISPR-based gene therapy—with its partner CRISPR Therapeutics. Meanwhile, Regeneron reported a market capitalization growth of 21.8% in 2023, primarily attributed to the FDA approval of its high-dose Eylea (aflibercept)—a VEGF fusion protein—for three eye diseases: wet age-related macular degeneration, diabetic macular oedema, and diabetic retinopathy. High-dose Eylea may offset standard Eylea’s expected sales decline following looming biosimilar competition, as well as regain Regeneron’s market share in eye diseases in response to Roche’s ANGPT2/VEGFA-targeted bispecific antibody Vabysmo (faricimab), which is also approved in wet age-related macular degeneration and diabetic macular oedema.

Moderna and Pfizer continued to witness a decline in market capitalization, of 45.1% and 43.5%, respectively, in 2023 due to the diminishing demand for their Covid-19 products. Furthermore, Pfizer announced in Q4 that its oral GLPR1 agonist danuglipron will not progress into Phase III trials for the treatment of obesity. Danuglipron was anticipated to rival Novo Nordisk’s Wegovy and Lilly’s Mounjaro in the weight loss drug market, amid efforts to mitigate post-Covid-19 declines in revenue.

See Also:

Bristol Myers Squibb reported a market capitalisation decline of 31.8% this year, largely due to the reduced sales of its blockbuster blood cancer drug Revlimid resulting from generic competition.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataJohnson & Johnson saw a market capitalisation decline of 18.3% in 2023, owed to the inclusion of its blockbuster drugs Imbruvica (ibrutinib), Stelara (ustekinumab), and Xarelto (rivaroxaban) in Medicare’s first ten drugs subject to pricing negotiation. These drugs had combined sales of $16.49bn in 2023. However, the FDA approval of Amgen’s Stelara biosimilar Wezlana (ustekinumab-auub) in Q4 may result in the removal of Stelara from the IRA’s Drug Price Negotiation Program, on grounds of “meaningful competition.”

Daiichi Sankyo’s market capitalization fell by 14.1% owed to concerns regarding efficacy and safety of its TROP2-directed antibody-drug conjugate datopotamab deruxtecan—jointly developed with AstraZeneca—for the treatment of non-small cell lung cancer (NSCLC) in its interim Phase III TROPION-Lung01 readout. However, with the FDA accepting the biologics licence application (BLA) for datopotamab deruxtecan in February 2024, with a Prescription Drug User Fee Act (PDUFA) date set for 20 December 2024, this may contribute to positive growth for Daiichi Sankyo next year.

The top biopharmaceutical companies that reaped success in 2023 shifted to those that developed weight loss drugs, such as Lilly and Novo Nordisk. Other biopharmaceutical companies continue to face generic and biosimilar drug competition, as well as reduced demand for Covid-19 therapies. In addition, ongoing US drug price negotiations under the IRA that allow Medicare to negotiate drug pricing, disincentivising small molecule drug development, may lead to a strategic shift in biopharmaceutical drug development away from small molecules and towards biologics, which remain unaffected by pricing negotiations for 13 years following approval under the IRA.

Related Company Profiles

Johnson & Johnson

Novo Nordisk AS

Vertex Inc

Regeneron Pharmaceuticals Inc

Roche Diagnostics International Ltd